Rumored Buzz on Offshore Company Management

Wiki Article

Indicators on Offshore Company Management You Should Know

Table of ContentsThe Basic Principles Of Offshore Company Management Not known Facts About Offshore Company ManagementAll About Offshore Company ManagementOffshore Company Management - Questions

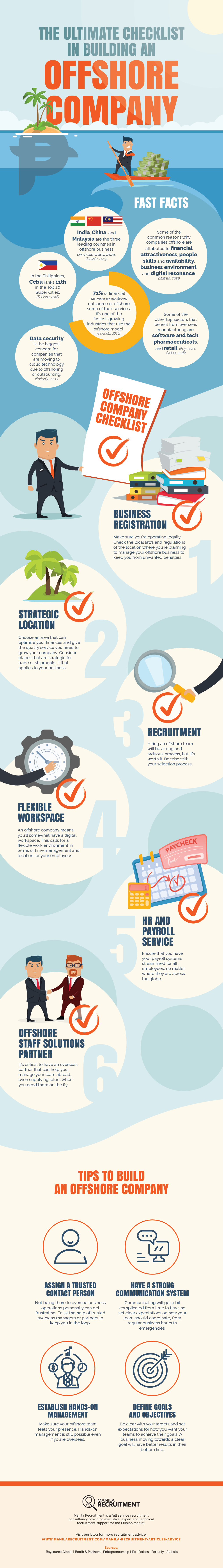

This is because the business is signed up in a various jurisdiction that is typically past the reach of tax authorities or rivals. For instance, if you are in the US, yet register the business in a territory like Seychelles or Belize, you can relax assured that your data is safe.Setting up an overseas company provides lots of tax obligation advantages since they are exempt from the higher tax obligations that onshore business have to pay. You will not be subjected to the exact same tax obligation prices as residential firms, so you can conserve a large amount on tax obligations. The jurisdictions where offshore companies are typically registered often have double taxes treaties with various other countries.

An overseas business is additionally more flexible pertaining to guidelines as well as compliance. The laws in the jurisdiction where you register the company might be less stiff than those in your house nation, making it simpler to establish the business and also run it without excessive paperwork or legal inconvenience. You will certainly also have added benefits, such as using the firm for international profession.

This is due to the fact that the company is signed up in a territory that may have much more flexible possession protection legislations than those of your house country. If you choose the ideal jurisdiction, financial institutions can not easily take or freeze your abroad possessions. This makes certain that any kind of cash you have actually invested in the company is safe as well as safe and secure.

Everything about Offshore Company Management

Offshore firms can be utilized as cars to shield your possessions versus prospective complaintants or creditors. This suggests that when you pass away, your beneficiaries will certainly acquire the possessions without disturbance from financial institutions. It is essential to seek advice from a lawful professional before establishing up an offshore business to guarantee that your possessions are effectively secured.Offshore territories typically have less complex needs, making completing the enrollment procedure and also running your service in a snap a wind. In addition, most of these jurisdictions supply online unification services that make it a lot more convenient to sign up a firm. With this, you can rapidly open a business bank account in the territory where your firm is registered.

Furthermore, you can quickly transfer funds from one checking account to an additional, making it simpler to manage and move cash around. When running a company, the danger of lawsuits is constantly present. Establishing up an offshore business can help lower the opportunities of being filed a claim against. This is due to the fact that the regulations in several jurisdictions do not allow foreign business to be sued in their courts unless they have a physical presence in the country.

About Offshore Company Management

Establishing a firm in another country can be rather easy. There are many countries that offer advantages to services that are seeking to establish an offshore entity. Some of the benefits of an overseas company include tax obligation benefits, personal privacy and also discretion, lawful defense and also property security. In this blog we will check useful reference out what an offshore firm is, positions to take into consideration for optimal tax benefits and likewise offshore incorporation as well as set up.

Several countries use tax benefits to firms from various other countries that transfer to or are incorporated within the territory. Companies that are developed in these offshore jurisdictions are non-resident since they do not carry out any type of economic purchases within their boundaries as well as are had by a non-resident. If you desire to establish an overseas business, you ought to utilize an unification representative, to make certain the documentation is finished properly as well as you get the best guidance.

Check with your formation representative, to ensure you do not break any type of constraints in the country you are creating the firm in around safeguarded company names. Consider the types of shares the business will certainly provide.

Offshore Company Management Can Be Fun For Anyone

Offshore company frameworks might hold a special status that makes them non reliant regional residential taxes or are required to pay tax obligations on their worldwide income, resources gains or earnings tax. offshore company management. If your offshore company is importing or exporting within an overseas place, as an example, receiving orders straight from the client and the acquired products being sent out from the maker.

For UK homeowners, offered no quantities are paid to the United Kingdom, the capital and also revenue gained by the overseas business stay tax-free. Tax obligation obligations typically are determined by the nation where you have permanent residency in and as beneficial owners of a company you would certainly be reliant be taxed in your nation of residence - offshore company management.

Tax obligation responsibilities differ considerably from country to country so its important to see to it what your tax obligations are prior to choosing a jurisdiction. Offshore firms are just subject to UK tax obligation on their revenues emerging in the UK. Also UK source rewards paid to an overseas company needs to be devoid of tax.

Report this wiki page